Are you a maker or a taker? Which ones better? Why does it even matter? We're going to be answering all those questions today.

You can't talk about maker or taker without also talking about fees, liquidity, the order book and order types. We're going to be covering some of these today, but I've also gone in depth into different order types, both buying and selling. I'll link those videos below. I'd really encourage you to start there and check those videos out if you're really not too familiar with different order types, because those are important when we're talking taker and maker.

Now with that, whether you're using Coinbase, Kraken Pro, Gemini Finance - any of these different exchanges, all of them offer a taker maker fee structure, and that's what we're going to be talking about today and why this matters. So with that, sit back, grab your favorite beverage, and let's jump into it.

Welcome to the channel. I'm Brian Logan. I am so thankful that you were here before we dive right into taker and maker. A few things. First, I'm going to be mostly showing you Coinbase Pro now if you use Kraken Pro or Binance or another cryptocurrency exchange, this is really applicable for most of those. If you do use Coinbase Pro or looking to use Coinbase Pro, I've actually got a link in the description below where you can get $10 worth of free Bitcoin for signing up through that link.

💵 Free $10 in Bitcoin [ Coinbase Sign-up ] https://bit.ly/3wusPIBb

🦺 PROTECT YOUR CRYPTO. What I use - Trezor T (affiliate): https://bit.ly/37bs0cX

💰 Up to 8.5% APY + Up to $250 of BTC [ BlockFi ]: https://blockfi.com/?ref=4df2937e

Second quick thing is I'm not a financial professional or advisor, so please do your own research before investing in cryptocurrency or stocks or anything else that we're going to be talking about today.

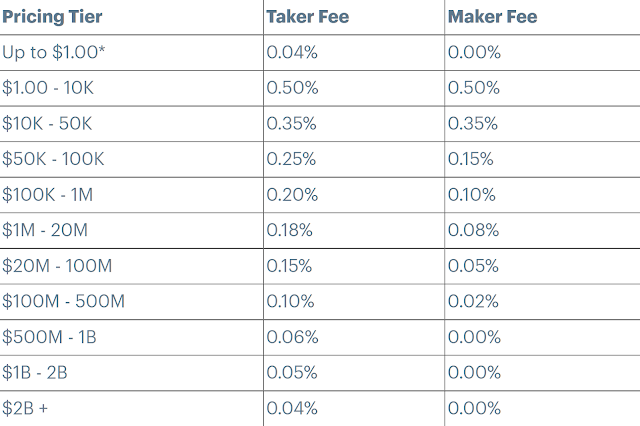

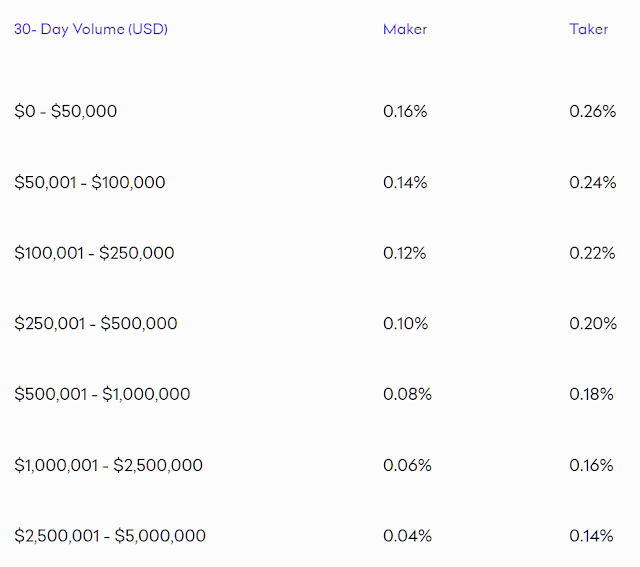

All right, let's dive into taker and maker. Taker or maker are what is used to determine what fee you pay when you trade cryptocurrency. Oftentimes, if you look up fee schedule or fee on Coinbase Pro or cracking pro or any of these exchanges, you're going to see a table that looks something like this it typically.

It has three columns. The first one is based off of how much you trade or the volume you trade. This determines what price tier you're going to fall into. The second is typically the taker fee and the third is the maker fee.

Let's look at the first column. This simply determines what pricing tier that you fall into, and it's based off of how much you've traded in the past 30 days, whether that's $500, a $1000 or $1,000,000. It's calculated over the past 30 days. How much you have traded on any of these exchanges and that determines then what taker or maker fee that you're going to be.

It's super easy to check this on Coinbase Pro and the other exchanges have this as well. You can simply go into orders fees and it shows you exactly how much you've traded over the past 30 days and what tier you fall into for both taker and maker so you don't need to keep track of how much you've traded in the past 30 days.

For now, something really important to note here with these pricing tiers. Depending on what exchange you use, sometimes you have to be trading a lot of money in 30 days in order to have your taker and maker fees be different. So in Coinbase that threshold is pretty high and to be honest I don't trade that much money on a 30 day basis, so typically my taker maker fees are the same.

However, if you jump over to Kraken Pro, the thresholds for the difference between taker and maker are larger and the pricing tiers start slower, so you definitely need to be aware of this. Generally how much you trade on a 30 day basis determines whether it makes sense for you to really pay attention to taker maker, or if it's not really going to matter for you because you trade lower volumes.

Now with that said, these schedules can change at any time, so you really do need to be aware of what taker and maker mean and how they influence your fees, and that's what we're going to get into.

So what's the difference? Between taker and make. It's all about liquidity. If you're a taker, you're removing liquidity from the market. If you're a maker, you're adding liquidity.

But what does liquidity mean? I like to think about liquidity in two ways. First is speed and the second one is value. With speed, it's how quickly can I get in and out of my specific coins like trading from U.S. dollar to Bitcoin or Bitcoin to the US dollar. What does that speed look like?

The second one is value, or really it's a fair price. If the market is really liquid, you're able to get a fair price for the asset or coin that you're exchanging. So to be very liquid, you want to be able to get in and out of the coin quickly, and you also want to get a really fair price for that coin whether you're buying or selling.

A huge driver of liquidity is volume or said another way - how many people are buying and selling? To give an example of very liquid coins - those would be like Bitcoin and Ethereum and others that trade a large volume every day. Other examples of things that are very liquid are cash, and the stock market for companies that are highly traded like Apple, Google, Amazon.

A few examples of not liquid assets would be real estate where it takes a really long time to have that transaction as well as altcoins and penny stocks, so things that are not traded by a lot of people and the market is so wide it's hard to get a fair price and hard to get in and out over time.

Now you know a lot more about liquidity and why it's so important. I'm not going to spend time here about how to find the most liquid coins or stocks, but if you're interested in that or other things to look for before investing in a coin or a stock, comment down below and I'll look to do a quick video on the things I look for before investing in a coin or a stock.

Now let's tie liquidity back to taker and maker fees. If you're a taker, you're taking liquidity from the market, if you're a maker, you're adding liquid. But how does this happen? How do you choose to be a taker and maker? It's all about order types. Now again I've created 2 videos on all the different types of orders, so please check those out above if you're unfamiliar with orders.

So what does orders have to do with it? Well, first of all, there's something called an order book, and it looks something like this on all the different platforms, and this order book simply keeps track of all the prices that buyers are willing to buy the coin and what price the sellers are willing to sell the price at. The exchange plays the role of getting all of these buyers and sellers together and matching up their orders.

So a huge thank you to Coinbase Pro and Kraken and all of these different exchanges because without them we wouldn't be able to efficiently and effectively trade our different coins.

The order book is where you can add liquidity by adding orders to it, or you can take away liquidity by taking orders from it. This is the difference between maker and taker. It comes down to order type. If all that sounded a little complicated, there's a very simple rule of thumb that will help you determine whether you're a taker or maker.

You are a taker if you're using a market order or a stop order. These are both orders that are filled immediately, forcing the exchange to take an order out of the book to fill your order. You are taking liquidity. You're a maker if you use a limit order, which means you're putting an order on the book that's not looking to be filled immediately. Now that's the general rule - market and stop orders, you're a taker, limit orders you're a maker.

Now two quick things on this. If you're using Coinbase Pro or some of these other exchanges, you can't just use a stop order, which is a taker order you have to use a stop limit order. So if it's stop limit, is it a taker or maker? Well, the way that most of you are using these and the traditional way to use these stop limit orders, whether it's a buy stop limit order or a sell stop limit order it's going to be a taker fee. The reason for that is because you're ultimately trying to immediately buy or sell the coin, which means it's taking liquidity from the market.

Now if you don't use these in the traditional stop limit sense, whether it's buy or sell, then you could potentially make it a maker order. If you're interested in learning more about that, comment down below or DM me and we can walk through that process. But really, the way that you use these stop limit orders generally know it's going to be a taker order instead of a maker.

Second thing I want to cover is pretty rare, but I want to throw it out there. If you're trading not very liquid markets or you have really really big order and not all of your order gets immediately filled, you could have an instance where your order is taken both as a taker and a maker, because not the entire order is filled immediately.

So the portion that is filled immediately would be charged at the taker fee and the rest of the order would be taken at a maker fee. Now again, this is really rare. And probably not something you're going to have to worry about, unless, again, you're trading really massive orders or you're trading in a very illiquid environment where orders can't be filled immediately.

So before I share my personal thoughts on taker and maker just to quickly summarize, if you're using a market, a stop or the traditional stop limit order whether it's buying or selling, you're going to be charged the taker fee. If you're using a limit order, you'll be charged the maker fee.

Now how do I personally think about Taker and maker. Honestly, I don't care that much and the reason for that is kind of three fold. The first one is that I tend to want to find lower fees overall, so what that means is I've created a video specifically for Coinbase of why you should be trading Coinbase Pro that uses a taker maker model versus Coinbase that uses more of a fixed rate fees.

Now the difference between these fees is significant. You're talking about 1,2,3 percent versus half a percent or less, so those are the areas that I really focus on saving money on fees. When you start getting into these small changes in taker and maker, the amount of volume that I trade and the size of the trades that I do that small change in percentage isn't as big of a deal to me as the major difference between like Coinbase and Coinbase Pro.

I would encourage you if you're not already trading on a pro platform like Coinbase Pro or Kraken Pro, you really should, because the difference between those and the standard fees are significant.

The second reason I already alluded to, and its that I'm not trading super frequently with large amounts of money, so I generally can't take advantage of big changes in taker and maker.

And lastly, I really like to get the prices that I want. My typical strategy involves a lot of stop limit orders, whether it be buy stops or sell stops. So for me not using limit orders that often I typically don't get charged the maker fee. I'm typically charged the taker fee. So that sums it up for me personally.

While I think taker and maker fees are extremely important and good to know and understand how they work. I think you should focus on bigger savings if you're not trading huge volumes or trading very frequently. And again, that's switching from like Coinbase to Coinbase Pro or using Kraken Pro or other exchanges that use the taker and maker fee structure. .

All right, that's it on Taker and maker. I really hope this is helpful and you have a better understanding of liquidity, order types, the order book and most importantly, taker and maker fees. If you have any other questions or want any more detail, please feel free to comment down below right now and I'll get back to you as soon as I can.

And with that, thank you so much for watching.

I'm Brian Logen.

Remember to stay healthy. Love your family and elevate your wealth.

Comments

Post a Comment